We acquire, partner, merge, amalgamate, or grow companies across several industries to build long-term value.

Xyra Group – Strategic Acquisitions for the Next Digital Era

Our Acquisition Strategy

Our acquisition strategy is defined and implemented in line with our corporate/business strategy and strategic plan where our approach is adding value all across.

Key Considerations for Acquisition

Financial analysis, HR analysis, Market analysis, Customers analysis, Suppliers analysis, Target market, Market attractiveness. environment analysis, Competitor Analysis, Benchmarking, Strategic group mapping, SWOT analysis, Xyra Groups growth strategy tools, Business model, Mission, vision and values, Balanced scorecard, strategic pillars to reach our strategic objectives, Potential strategic initiatives in each strategic pillar and prioritisation and indeed if its profitable, scalable and expandable acquisition target.

Key Considerations for Acquisition

Financial analysis, HR analysis, Market analysis, Customers analysis, Suppliers analysis, Target market, Market attractiveness. environment analysis, Competitor Analysis, Benchmarking, Strategic group mapping, SWOT analysis, Xyra Groups growth strategy tools, Business model, Mission, vision and values, Balanced scorecard, strategic pillars to reach our strategic objectives, Potential strategic initiatives in each strategic pillar and prioritisation and indeed if its profitable, scalable and expandable acquisition target.

Helping Management

Commit to an above market pay, KPI-driven results, building strong relationships, leading care cities globally with domiciliary care synergy.

Acquisition Verticals

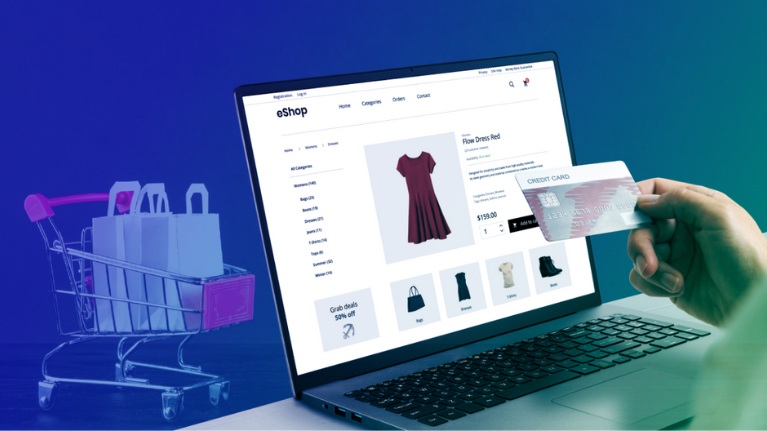

Xyra Group are focused acquiring businesses in many sectors, with focus on ecommerce businesses, retail businesses, marketing businesses, and A.I. businesses.

Acquisition Verticals

Xyra Group are focused acquiring businesses in many sectors, with focus on ecommerce businesses, retail businesses, marketing businesses, and A.I. businesses.

Valuation Philosophy & Strategy

We are not brokers. We are builders. Xyra Group values each business based on a balance of fundamentals, growth potential, and strategic fit. We operate with speed, discretion, and fairness, offering founders clean exits or structured earnouts with shared upside. Typical EBITDA valuation ranges by vertical:

Vertical(s)

- E-commerce & Retail

- A.I.

- Marketing & SEO

- Mobile Applications

- Media / Newsroom

- Recruitment

- Cybersecurity

- Blockchain Infrastructure

- Telecommunication

Valuation Range (EBITDA Multiple)

- 2.0x – 4.0x

- 3.0x – 6.0x

- 2.0x – 3.0x

- 4.5x – 6.0x

- 3.0x – 5.0x

- 3.0x – 5.0x

- 6.0x – 10.0x

- 4.5x – 8.0x (with proof of utility)

- 4.0x – 6.5x

Our Industry Reports

Executive Summary

Amazon FBA Industry Report

Amazon FBA (Fulfillment by Amazon) remains a dominant force in the global e-commerce ecosystem. The model enables third-party sellers to leverage Amazon’s vast logistics network, trusted platform, and built-in traffic. As Amazon crosses $600 billion in annual GMV, FBA sellers contribute over 60% of all units sold. Despite margin compression and increased competition, FBA businesses with differentiated products, strong review moats, and operational discipline are prime candidates for acquisition and scaling.

Executive Summary

Cybersecurity Products Industry Report

The cybersecurity products sector is entering a golden age. As digital infrastructure becomes more complex, threats more advanced, and regulations tighter, demand for scalable, modular, and user-friendly security products is surging. From B2B SaaS platforms to consumer-focused security tools, the market is driven by trust, defensibility, and recurring revenue. For investors, acquiring niche, cash-flowing cybersecurity software offers robust upside with sticky customer bases and enterprise-grade multiples.

Executive Summary

Digital Agencies Industry Report

Digital agencies spanning performance marketing, SEO, creative, and media buying remain mission-critical in today’s commerce and content economy. As brands shift toward measurable, data-driven marketing, agencies that deliver ROI and build repeatable growth systems are in high demand. Despite competitive pressures and commoditization risk, agencies with niche specialization, recurring retainers, and media ownership assets are highly valuable and acquisition-ready.

Executive Summary

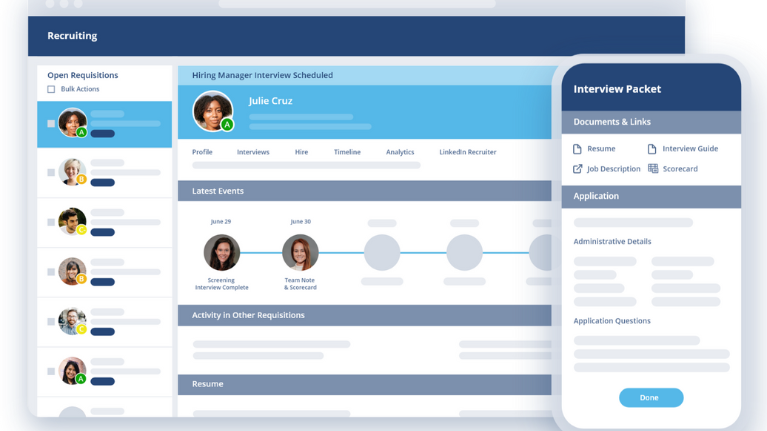

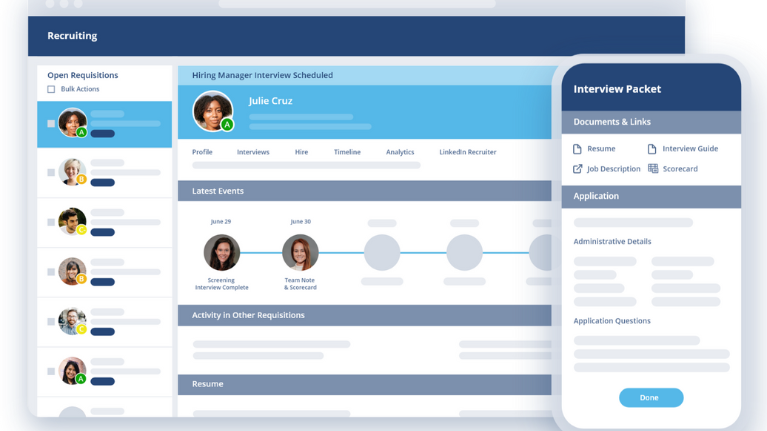

Recruitment Platforms & Services Industry Report

The recruitment industry is undergoing a digital transformation. AI-driven platforms, on-demand staffing models, and niche job marketplaces are rapidly replacing traditional recruiting firms. Businesses seek faster, more cost-effective ways to acquire top talent while candidates demand frictionless, mobile-first experiences. MRR-based SaaS platforms and tech-enabled recruiting services with strong placement metrics, recurring contracts, and scalable delivery are highly sought-after acquisition targets in 2025.

Executive Summary

Telecommunications Industry Report

The telecommunications sector is undergoing rapid digitization, consolidation, and platformization. Traditional telcos are being disrupted by cloud-native infrastructure, VoIP platforms, embedded communications APIs, and global demand for connectivity. While infrastructure remains capital-intensive, software-enabled telecom services (CPaaS, UCaaS, VoIP) offer high-margin, recurring revenue models attractive to digital-first investors. The convergence of telecom, SaaS, and AI is unlocking M&A opportunities for scalable, defensible assets in a historically slow-moving industry.

Executive Summary

E-Commerce & White-Label Industry Report

The e-commerce and white-label sectors remain amongst the most dynamic and scalable industries globally. Driven by platform innovation, supply chain accessibility, and consumer demand for direct brand experiences, this space continues to deliver high-margin opportunities for investors and operators alike.

Executive Summary

News & Media Sites Industry Report

Digital news and media sites have evolved beyond traditional journalism into high-margin, traffic-driven businesses. With multiple monetization layers ads, affiliate, subscriptions, data licensing, and sponsored content media sites with niche authority, SEO strength, and loyal audiences can be highly scalable, profitable, and undervalued. As Google’s algorithm changes and AI content rise, defensible media brands with engaged readerships and proprietary distribution channels are commanding attention from digital investors.

Executive Summary

Recruitment Platforms & Services Industry Report

The recruitment industry is undergoing a digital transformation. AI-driven platforms, on-demand staffing models, and niche job marketplaces are rapidly replacing traditional recruiting firms. Businesses seek faster, more cost-effective ways to acquire top talent while candidates demand frictionless, mobile-first experiences. MRR-based SaaS platforms and tech-enabled recruiting services with strong placement metrics, recurring contracts, and scalable delivery are highly sought-after acquisition targets in 2025.

- Download Full Report

Executive Summary

E-Commerce & White-Label Industry Report

The e-commerce and white-label sectors remain amongst the most dynamic and scalable industries globally. Driven by platform innovation, supply chain accessibility, and consumer demand for direct brand experiences, this space continues to deliver high-margin opportunities for investors and operators alike.

- Download Full Report

Industries We Acquire In

Retail & Amazon

Marketing & SEO

Mobile Applications

Media & Newsroom

Recruitment & Talent

Cybersecurity

Blockchain & Infrastructure

Telecommunication

Our Operational Focus Areas

Operations

Operations serve as the crucial link between an organisation’s overarching strategy and its sustained success.

Capital Excellence

Maximising returns by applying leading practices in capital projects and delivery.

Manufacturing & Supply Chain

Enhancing global manufacturing and supply chain performance.

Service Operations

Improving customer experience and organisational efficiency.

Product Development & Procurement

Designing and transforming products and services to optimise portfolio value

With gen AI, helping green businesses strengthen our ‘blue economy’

Using generative AI technologies, McKinsey is helping One Ocean Foundation create an accurate picture of how businesses are sustaining our oceans.

What We Bring

How we can help

We develop a focused M&A plan, leverage GenAI to identify targets, and provide thorough strategic, financial, and cultural diligence.

Integrations

We customise integration strategies for faster, more sustainable value creation with reduced risk, ensuring measurable results.

Separations & IPOs

We realise value through strategic separations, portfolio adjustments, and executing IPOs and other capital market

moves.

Joint Ventures & Alliances

We design partnership strategies, set up governance, build operational models, and monitor performance to drive value.

Our Global Leadership

Xyra Group is led globally

by world class business professionals.

What We Do

Xyra Group at the heart is an acquisitions vehicle. We are buying companies in the following industries:

Retail, Amazon, Marketing, Media, SEO, Mobile Applications, Recruitment, Newsroom, Cybersecurity, Blockchain, and Telecommunication.

We focus on five key thing

- Operations serve as the crucial link between an organisation’s overarching strategy and its sustained success. In today’s environment, organisations that effectively leverage operations to accelerate progress and develop new capabilities at scale consistently achieve a competitive edge.The Xyra Group operations practice is positioned at the convergence of strategy, technology, and transformation to drive sustainable, inclusive growth. We align boardroom-level strategies with frontline implementation, strategically integrating technology where impactful, and expediting enduring transformations through comprehensive capability development.

- Capital Excellence: Maximising returns by applying leading practices in capital projects and delivery.

- Manufacturing & Supply Chain: Enhancing global manufacturing and supply chain performance.

- Product Development & Procurement: Designing and transforming products and services to optimise portfolio value.

- Service Operations: Improving customer experience and organisational efficiency.

What We Buy

Xyra Group approaches retail not as mere trade, but as an ecosystem of trust, technology, and tactical supply. Our retail strategy targets high-margin, recurring-revenue businesses with defensible brands and operational scale. Through Amazon FBA and direct-to-consumer channels, we identify sellers with loyal customer bases, review moats, and untapped global potential. We implement professionalised logistics, dynamic pricing, and advanced inventory analytics to unlock both profit and longevity.

We regard marketing not as noise, but as the strategic shaping of attention and conversion. Xyra acquires agencies and IP holding companies with proprietary tools, battle-tested funnels, and demonstrated ROI across Google, Meta, TikTok, and affiliate ecosystems. In SEO, we favour performance-based models, content networks with enduring rankings, and assets powered by AI-enhanced publishing. These units are vertically integrated to support the group’s owned brands and external clientele.

The app economy is the frontline of user engagement. Xyra targets mobile application portfolios that are profitable, scalable, and built upon utility or habit—spanning wellness, productivity, B2B tools, and subscription-based digital services. We focus on user retention, monetisation frameworks, and cross-app synergy. App studios under our banner benefit from shared marketing resources, data science, and SDK-level optimisations.

Information is the new frontier of influence. Our investments in media and newsroom assets are guided by traffic strength, editorial authority, and monetisation through subscriptions, native advertising, and licensing. We favour niche dominators, high-trust content, and scalable syndication models. The Xyra Network amplifies reach through cross-platform content architecture and centralised ad tech infrastructure.

People are the foundation of scale. Xyra targets recruitment platforms, HR tech solutions, and talent agencies with proprietary databases, automated sourcing tools, and high fill rates in specialist industries. We streamline hiring engines through AI matchmaking, ATS integration, and employer branding frameworks, delivering talent at speed and with surgical precision.

In an age of digital warfare, security is not a feature—it is a necessity. Xyra acquires cybersecurity firms offering endpoint protection, threat intelligence, data encryption, and compliance tooling. Our strategy centres on B2B SaaS models, government-grade protocols, and sectors with rising regulatory oversight. We deploy our capital and expertise to globalise reach and deepen trust.

Xyra is not in pursuit of hype; we invest in infrastructure. We acquire blockchain firms with real-world utility: smart contract platforms, enterprise integrations, decentralised storage, and regulatory-compliant tokenisation. Our mandate is to separate signal from speculation and scale technologies that will endure the next digital cycle.

Communication is commerce’s backbone. Xyra targets telecom ventures in VoIP, cloud PBX, mobile MVNOs, and infrastructure providers with favourable ARPU and minimal churn. Our aim is to consolidate niche operators, reduce redundancy, and scale through unified platforms and aggressive B2B provisioning

Valuation Multiples & Acquisition Philosophy

We are not brokers. We are builders. Xyra Group values each business based on a balance of fundamentals, growth potential, and strategic fit. We operate with speed, discretion, and fairness, offering founders clean exits or structured earnouts with shared upside. Typical EBITDA valuation ranges by vertical:

Vertical

- Retail / Amazon

- Marketing & SEO

- Mobile Applications

- Media / Newsroom

- Recruitment

- Cybersecurity

- Blockchain Infrastructure

- Telecommunication

Valuation Range (EBITDA Multiple)

- 2x – 4x

- 2x – 3x

- 4.5x – 6 x

- 3.0x – 5.0x

- 3.0x – 5.0x

- 6.0x – 10.0x

- 4.5x – 8.0x (with proof of utility)

- 4.0x – 6.5x

What We Bring

With over two centuries of experience, and £30 billion in transaction.

How we can help

M&A Strategy & Due Diligence We develop a focused M&A plan, leverage GenAI to identify targets, and provide thorough strategic, financial, and cultural diligence.

Integrations

We customise integration strategies for faster, sustainable value creation with reduced risk, ensuring measurable results.

Separations & IPOs

We realise value through strategic separations, portfolio adjustments, and executing IPOs and other capital market moves.

Joint Ventures & Alliances

We design partnership strategies, set up governance, build operational models, and monitor performance to drive value.

Corporate Finance

The team applies financial expertise and specialized tools to support organisational value.

- CFOs are often viewed as key executives after the CEO and currently face significant challenges. Corporate performance is monitored closely, risks—including cybersecurity—are growing, and there is increasing demand for improved data analytics and more effective business models. Providing finance services efficiently continues to be a challenge. The team has experience in raising finance.

- Corporate and Capital Markets Strategy: Effective strategies integrate value creation with risk management. Through collaboration with Strategy & Corporate Finance Insights, vendors receive guidance in aligning corporate strategy with market perspectives, articulating strategic goals, and presenting information to investors.

- Capital-markets analysis to identify which business models add value

- Portfolio management to support growth and optimise long-term outcomes

- Investor communications to explain strategy, manage stakeholder expectations, address shareholder value, and respond to investor concerns

- Financing strategies to support corporate value

- Value-Based Management

- CFOs are involved in bringing stakeholders together around value creation and can use the finance function to implement new initiatives and best practices.

- Performance measurement and management using analytical tools and methodologies to assess value and performance

- Finance organisation design to support business needs and deliver value through diagnostics and centre of excellence solutions

- Lean finance, focusing on improving efficiency and productivity in finance functions

- Finance talent management, developing strategies, systems, and leadership skills through Finance Academies to build effective finance teams

Please submit your brand snapshot at vb@xyragroup.com. Please explain where your business is located, its size, history, and strategic growth plans. We collaborate with founders seeking tailored exit or growth strategies.